Why is mBASIS the highest yielding stablecoin strategy in DeFi?

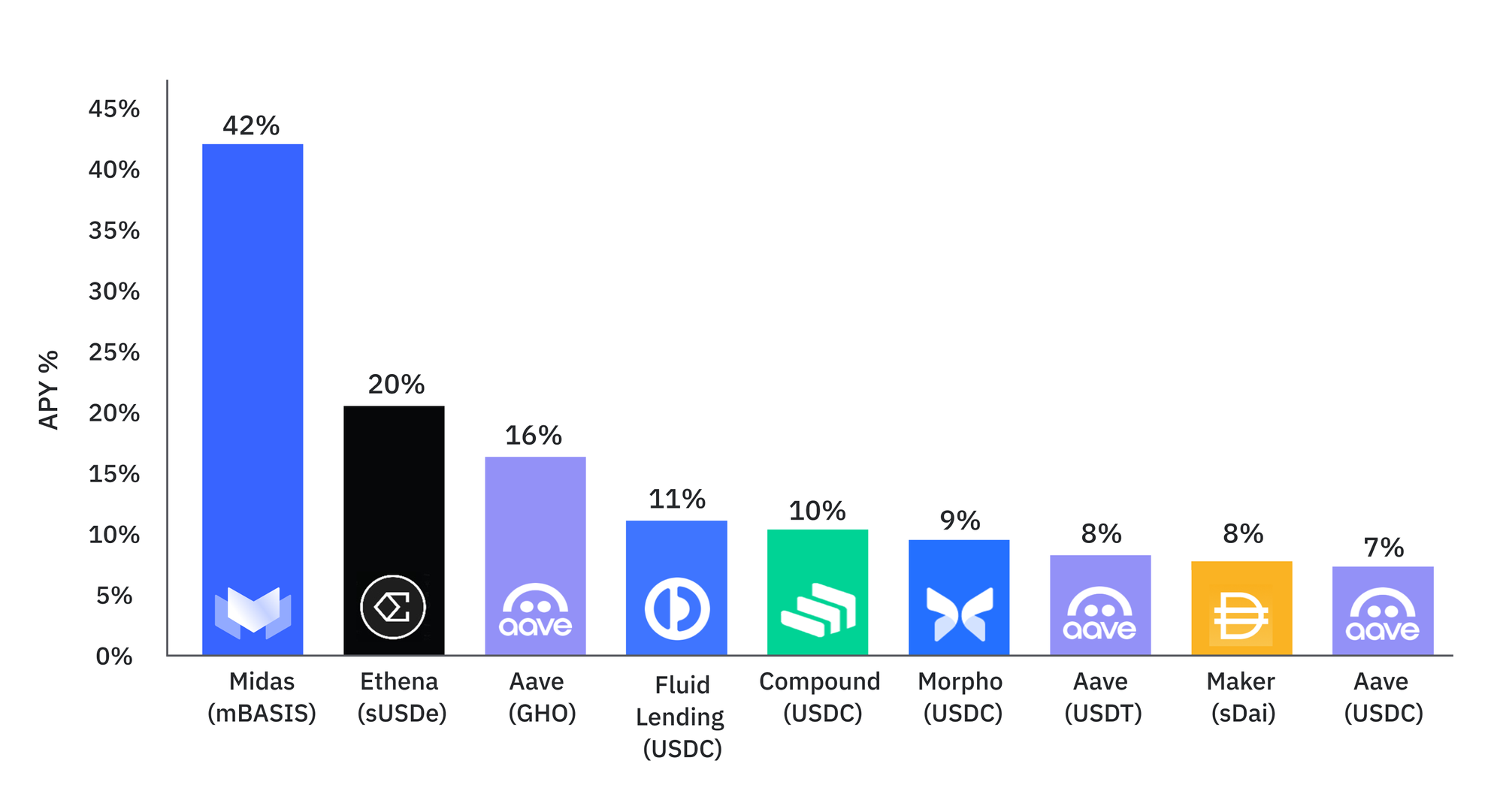

mBASIS has generated 33% year-to-date and 42% annualised over the past two weeks in a USD (delta) neutral strategy. This makes mBASIS the highest yielding strategy for stablecoin holders in DeFi, as seen in the chart below.

In this article, we outline what has driven the performance of mBASIS, how it compares to prevailing alternatives, cover the associated risks with the strategy and discuss opportunities for DeFi integrations.

This article is for illustrative purposes only and does not constitute investment advice. Past performance is not an indication of future performance.

I. What is driving performance: ‘The golden touch’

mBASIS is a market neutral (‘delta’) investment strategy that deploys stablecoin into a crypto-basis trading strategy. During bullish market environments basis is among the most profitable delta neutral strategies in crypto, as outlined in section II.

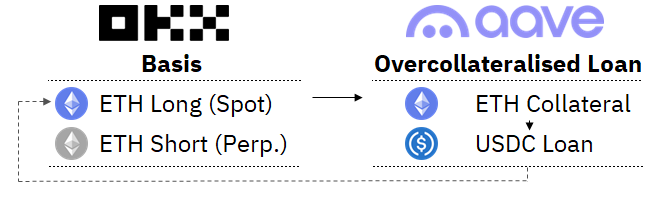

mBASIS outperforms the conventional basis-trade by introducing a moderate turn of leverage and thereby increasing the capital efficiency of the strategy. A proportion of the spot-leg of the basis trade (e.g. ETH held on OKX) is used as collateral for an over-collateralised loan on DeFi money-markets (e.g. Borrow USDC on Aave).

The introduction of a turn of leverage from DeFi money-markets (Aave), translates into superior performance, as outlined in the table below. The key insight is that typically the cost of borrowing is below the rate of return of basis – by closing the gap, mBASIS is introducing a more capital efficient exposure to a basis position - giving the strategy the ‘golden touch’.

At 2x of leverage, the APY of mBASIS implies ~43% instead of 20% for conventional basis. The introduction of leverage introduces liquidation risk, however, since the position on the CEX and DeFi venue are inverse, the position remains dollar neutral as long as the health ratios are actively maintained according to the respective price movements.

In section IV, we review the risks of the strategy in more detail and in section V we outline how the risks are mitigated.

II. Why is basis profitable in contango crypto markets?

Basis capitalises on the price difference between an asset's future and spot markets. This approach thrives in crypto markets due to their inherent volatility and frequent periods of market euphoria.

In bullish markets, investors, often retail investors, seek leveraged positions to maximize returns on upmarket, deploying into futures contracts and driving their prices above spot levels. This creates a positive basis, as the futures premium reflects the high demand for leverage.

III. How can I invest?

Eligible users can access mBASIS on www.midas.app/mbasis

IV. What are the risks?

Investing in digital assets involves risks and investors should consider those before making investment decisions. While mBASIS is a USD neutral instrument, it should be noted that the asset is not a stablecoin and can appreciate or depreciate in value.

Risks in the basis trade:

(a) Counterparty risk: This involves exposure to exchanges, custodians and stablecoin issuers holding the underlying assets. Given the interconnected nature of the industry, this remains a critical consideration.

(b) Execution risks: When trading cryptocurrencies, the mBASIS strategy may face execution risks due to market volatility and liquidity shortages. Large trades can create price slippage, meaning the executed price may differ from the expected one, negatively impacting the portfolio's value.

(c) Market risks: Market volatility can result in liquidation. While the strategy is hedged, risks remain.

(d) Negative funding rates: Funding rates can generate negative returns. While this does not expose investors to price drops of the spot asset, it should remain a consideration.

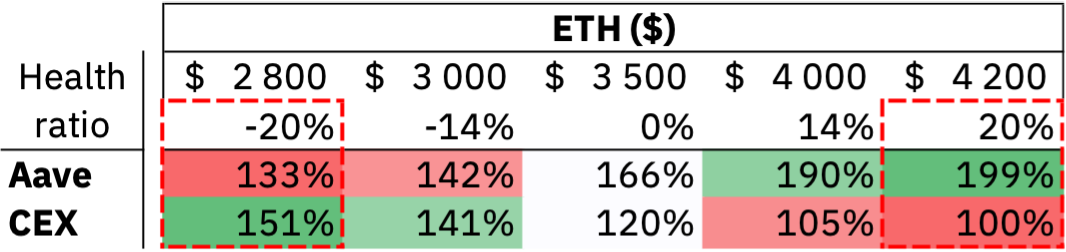

(e) Liquidation risk: The introduction of leverage of mBASIS can result in liquidation. As outlined in the table below, large price moves in the spot asset can introduce liquidation risks.

(f) Smart contract risks: Risks involving failure of smart-contracts and hacks are heightened when interacting with protocols such as Aave.

Risks should be considered in context of the reward. For more details specifically to mBASIS, please view link.

V. How are risks mitigated ?

Midas is building institutional grade assets for the open web.

Midas employs a robust framework to mitigates risks arising from (a) counterparty and (b) execution risk by working exclusively with high quality and regulated counterparties. It should be noted that risks can be reduced, but not eliminated entirely. Inherently the hedge of the short position relies on the existence of a centralized exchange (i.e. OKX/Binance) in any involving perpetual futures.

Risks related to the (c) market and (d) negative funding rates are related to market conditions. The hedging of the position mitigates the risk from a depreciation in the spot asset and while periods of negative funding rates are historically self-correcting, investors should be mindful that these can occur periodically.

Importantly, the risk of liquidation should be considered with the introduction of leverage. As shown in the table below, the health ratios on CEX and DeFi venues move inversely with the price of the spot asset. As such, positions have to be moved according to price movements.

The table below outlines the liquidation risk at a range of price moves of the spot asset. As shown in the table, the health ratios on the respective venues are inversely proportional to the price move. For instance, the health ratio of Aave improves as the price of ETH appreciates while the health ratio on the CEX deteriorates (as the short position increases).

The risk of liquidation is mitigated as long as the collateral assets are updated on the respective venues. A price moment of -/+20% would trigger a liquidation unless the collateral assets can be moved across the venues. Automated processes would minimise the execution to less than 30 minutes.

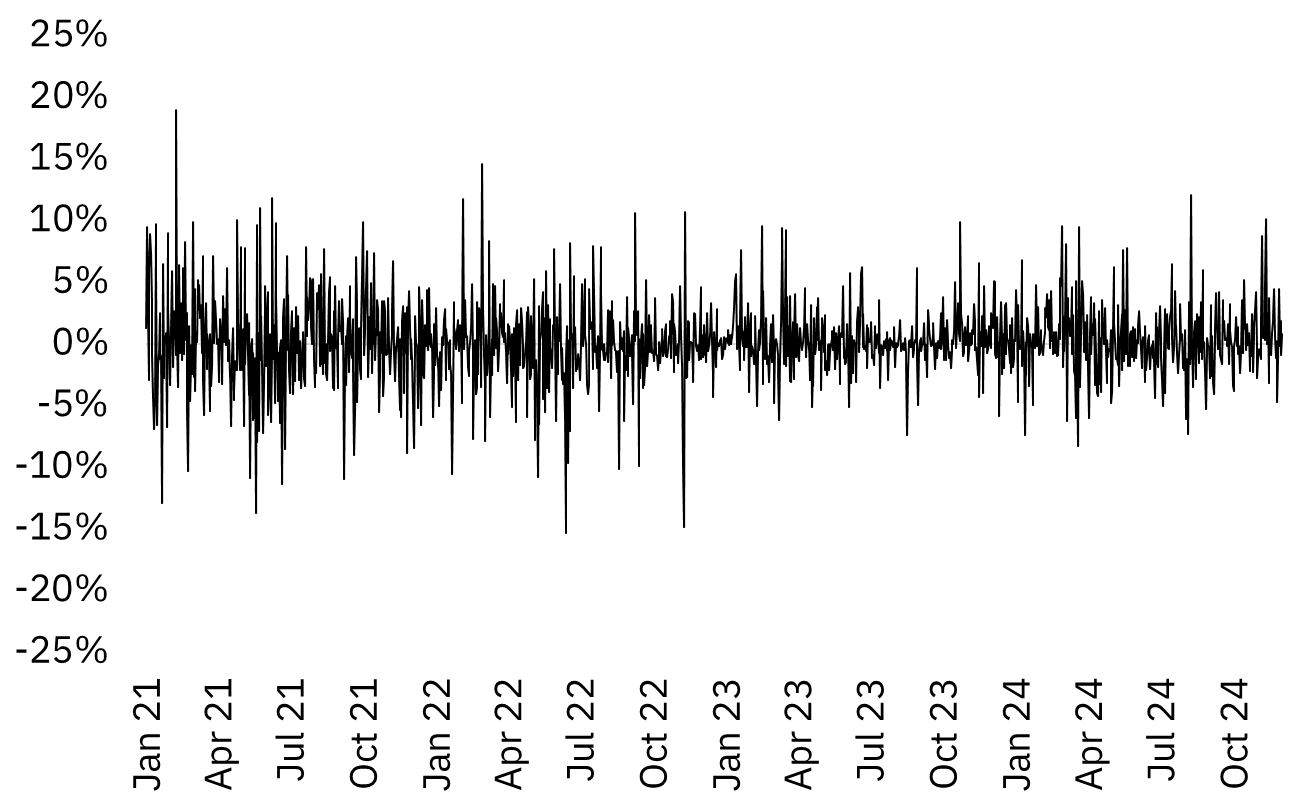

For context, the biggest negative daily price move in BTC over the past 3 years was 15%, as shown in the chart below.

VI. Why do DeFi protocols want to integrate the mBASIS?

Midas’s tokens are built for DeFi.

The integration of mBASIS as a collateral on DeFi money-markets, allows borrowers to profitably borrow idle stablecoins until the gap between the borrow rate and the native APY of mBASIS converges. In return, this raises the utilization of the respective market and increases the supply rate of USDC, thereby increasing the attractiveness of the market for lenders.

In order to facilitate efficient lending markets, the liquidation of loans and reliability of the price oracle are critical requirements. As such, mBASIS has an instant redemption facility and an independently verified price oracle.

(a) How does the redemption work?

- mBASIS offers instant redemption in USDC of a portion of the portfolio, with the remainder being invested in highly liquid underlying.

- The instant redemption facility can be viewed on midas.app/mbasis.

- This allows any holder of mBASIS to permissionless redeem for USDC, which facilitates effective liquidation mechanisms.

(b) How does the Price Oracle work?

- The price oracle of mBASIS follows a proof-of-reserve mechanism, where the net asset values are independently reported, verified and propagated on-chain.

- The current price of mBASIS and reporting can be viewed under midas.app/mbasis.

- Users can redeem the assets at the onchain price.

mBASIS is being integrated on the leading vaults on Morpho and soon other DeFi money markets such as Euler Finance and others. Midas does not operate DeFi protocols nor stablecoins, and positions itself complementarily to DeFi projects.

Finally, as a portion of the assets within mBASIS are lend on DeFi markets, Midas positions itself complementarily for the lending markets for ETH, wrapped BTC and others.

Disclaimers & risk disclosures

Midas-issued tokens are strictly not available to U.S. persons, entities, or any individuals or entities connected to the U.S. as defined under U.S. securities laws.

The investors’ redemption claim is subject to a qualified subordination. As a result, an investor bears a risk higher than that of a regular lender. Thus, investors only have a claim against the Issuer for redemption to the extent that the assertion of the claim would not lead to insolvency of the Issuer (insolvency, imminent insolvency or over-indebtedness). This may result in payments to investors being delayed or even cancelled altogether. Furthermore, in the event of the Issuer's insolvency or liquidation, the investors’ claims under the token-based bonds will be subordinated to the claims of all other creditors of the Issuer which be serviced with priority. The subordinated claims of the creditors of the token-based bonds may only be settled from existing or future annual net profits, any existing or future liquidation surplus or other free assets of the Issuer. The total loss of the invested capital may result from this.