Start your engines. Our proposal for the Spark Tokenization Grand Prix.

When Fabrice and I founded Midas, our ambition was to make investing work like the internet, open and accessible to anyone. This aligns with Sky’s values for USDS to be inclusive and accessible regardless of circumstance, constructing an unbiased financial system.

Sky has been instrumental in the formation of decentralised finance pioneering the development of a stable and decentralised financial ecosystem. Sky has grown USDS to become among the largest decentralised stablecoins globally.

To further support Sky’s vision, we are excited to present our proposal for the Sky Tokenization Grand Prix:

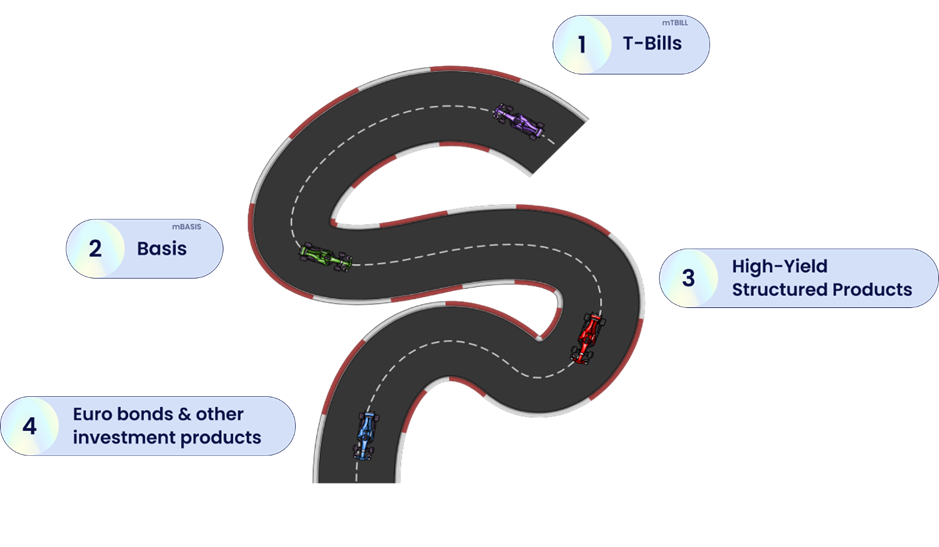

I. Beyond U.S. T-Bills, Midas provides Sky exposure to best-in-class yield products across the market cycles, including Perpetual Funding Rates and High-yield structured products.

Sky is DeFi’s best place to save. Midas supports this ambition to provide the Sky community with exposure to best-in-class tokenized yield products across the market cycles.

- Bear Markets: mTBILL offers exposure to high-quality tokenized T-Bills, ensuring the best interest rates on USD even in the absence of contango crypto markets.

- Bull Markets: mBASIS provides exposure to perpetual futures funding yield through an institutional-grade basis trading strategy.

As Sky aims to scale USDS to +100 billion, its collateral backing is destined to include a broad backing. Midas is well-positioned to support this scaling effort with high-quality yield products such as corporate bonds, and non-U.S. foreign debt (such as Euro-bonds and other on-chain structured products).

Midas has received regulatory approval to tokenize a broad range of securities such as stocks, bonds, and crypto derivative or yield-bearing stablecoin investments. This strategically aligns us with Sky’s long-term goals and enables us to provide a high-quality yield to power USDS.

Product roadmap for Sky beyond the Tokenization Grand Prix

II. Midas’ yield-tokens are designed for lending use-cases in SparkLend, strategically aligning itself with the SparkDAO.

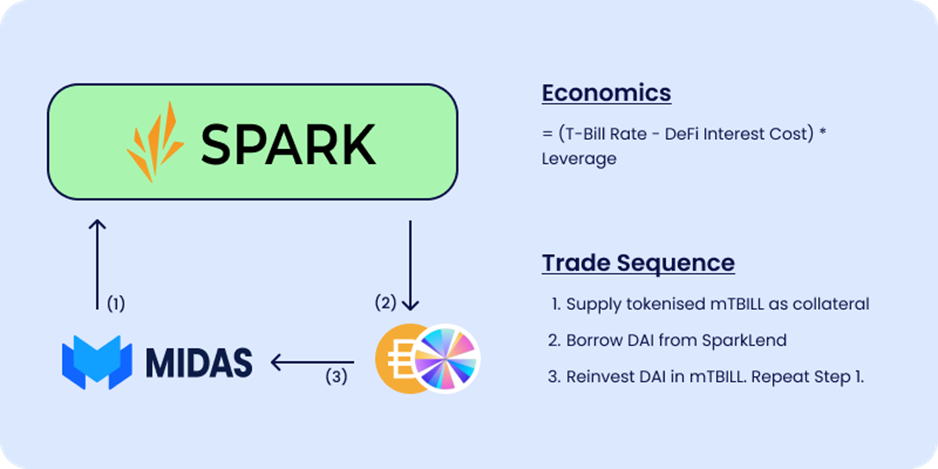

Midas’ yield-tokens are designed for lending use cases in SparkLend, strategically aligning itself with SparkDAO. Money markets are a vital component of DeFi, with strong demand demonstrated by an excess of $50 billion in total value locked (TVL) in lending protocols during the last cycle. Spark focuses on lending and DeFi use cases within the Sky ecosystem and has become one of the largest DeFi protocols in the market.

The foundation of effective money markets lies in seamless collateral auctions to protect lenders in case of loan defaults, especially during volatile market conditions. In SparkLend, liquidations are open to anyone, enabling an efficient collateral liquidation process. Midas’ tokens are permissionless in secondary transfers, allowing liquidators to bid for defaulted loan assets and recover lenders’ debts. This feature is crucial for DeFi money markets and is already live in Midas’s Morpho Vault.

Additionally, since mTBILL provides instantaneous redemptions, liquidators can immediately redeem the net asset value (NAV) of the underlying assets, mitigating market exposure risks.

Onboarding tokenized T-Bills like mTBILL or mBASIS on SparkLend will continuously elevate the base rate of lending in DeFi. Economic forces will narrow the gap between interest rates in DeFi, CeFi, and traditional markets, as arbitrage opportunities between markets are addressed with on-chain integration.

This process will democratize access to high-quality yield products on SparkLend for anyone with internet access, even without banking system access or direct exposure to tokenized securities, aligning with Sky’s ambition to rewire the global financial system.

Yield transfer via economic forces on SparkLend

Since the permissionless design is supported by mTBILL and mBASIS by default, users of SparkLend can profitably engage in opportunities across market cycles.

III. Midas is strengthening the utility of USDS.

Midas is committed to enhancing the utility of USDS and the Sky ecosystem. This commitment begins with integrating USDS into Midas’ product suite, allowing users to request issuance and redemption of mTBILL or mBASIS using USDS. This offers USDS holders attractive investment options and bolsters the overall utility of USDS.

We are excited to share that our partners share the commitment to Sky’s ecosystem:

- Flowdesk, GSR, and Wintermute are liquidity partners, committed to providing liquidity between mTBILL/USDS for large investments as part of the Tokenization Grand Prix.

- Hex Trust and Rakkar Digital provide Qualified Custody support for Midas-issued tokens, safeguarding assets for institutions and high net-worth investors.

- Copper (Clearloop) provides an industry-leading Off-Exchange Settlement (OES) solution, mitigating exchange risk and reducing operational complexity.

- Chronicle is an Oracle solution that has exclusively secured over $10B in assets for the Maker ecosystem since 2017. Chronicle is providing oracles for mTBILL on L2s, propagating the primary market oracle on Ethereum.

- DeFi venues such as Morpho, and Euler support Midas’s yield-token.

Midas shares deep ties with large active participants in the Sky ecosystem. BlockTower and Framework Ventures are also significant holders of MKR and long-standing ecosystem participants and co-led Midas’s $9mn investment round. Beyond that, Midas is backed by blue-chip VCs including HV Capital, Cathay Ledger, 6th Man Ventures, Hack VC, GSR, and Coinbase Ventures, among others.

Midas is an asset tokenization protocol bringing regulatory-compliant exposure to institutional-grade assets onchain, unlocking DeFi composability for real-world assets (RWA).

Disclaimer: Midas-issued tokens are not available to persons and entities in the US, China, and to those in sanctioned countries. Midas-issued tokens are also not available to individuals in the UK. Past performance is no indicator of future returns.

Click here to read the proposal in full!