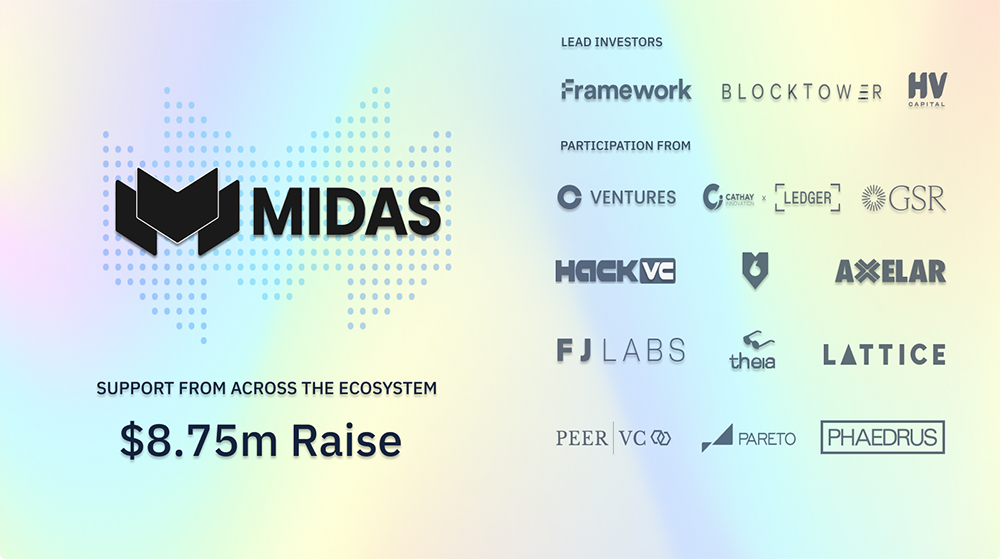

Midas Raises $8.75 Million Funding Round Led by Framework Ventures, BlockTower and HV Capital

Today marks a new chapter in decentralised finance (DeFi) as Midas announces an $8.75 million funding round, led by visionary firms Framework Ventures, BlockTower and HV Capital. We're also honored by the commitments from Cathay Ledger, 6th Man Ventures, Hack VC, GSR, Lattice Capital, Phaedrus, Theia Blockchain, Pareto, Axelar Foundation, Peer VC, FJ Labs, and Coinbase Ventures, whose commitments reinforce our mission to bridge the realms of traditional and decentralised finance.

After more than two years of intensive research, we’re thrilled to unveil mTBILL. This ERC-20 token, tracking short-dated U.S. Treasury Bills via an ultra-liquid BlackRock Treasury fund, offers an innovative way for stablecoin investors to earn yield on-chain, seamlessly melding the worlds of traditional finance and decentralised finance.

Stablecoins represent more than just an anchor in the volatile seas of cryptocurrency; they’re a lifeline for efficient, cross-border transactions. As traditional financial systems grapple with layers of intermediaries and protracted processing times, stablecoins emerged as the swift, cost-effective alternative for global transfers.

However, the last few years have seen a dramatic shift in their supply, coinciding with rising interest rates. The pivot of capital to traditional securities underscores the need for a DeFi solution that can offer competitive returns. mTBILL is engineered precisely to meet this challenge, distributing yield on-chain while enabling free participation in the DeFi ecosystem.

In the rapidly evolving world of finance, Midas stands at the forefront of innovation. With the introduction of mTBILL, we're not just participating in the market; we're aiming to redefine it. Our token represents a bold step forward, merging the reliability of traditional financial instruments with the efficiency and accessibility of DeFi.

mTBILL offers a sustainable, equitable, and fully compliant method for investors to tap into the yield potential of U.S. Treasury Bills, leveraging the best of both worlds to secure a future where financial empowerment is accessible to all.

Hear from Those Who Believe in Our Vision

As we chart this ambitious course, the support and insight of our investors reinforce the potential of Midas to make a lasting impact. From leading venture capitalists to seasoned finance professionals, the consensus is clear: Midas's approach to bridging the gap between traditional finance and DeFi through mTBILL is not only innovative but necessary for the next stage of financial evolution.

A trailblazer in crypto venture capital, Framework Ventures is renowned for propelling multi-billion-dollar DeFi and web3 gaming projects to success.

This leading investment firm merges professional trading and portfolio management expertise with digital asset strategies.

With a legacy of 23 years and €2.8 billion in managed assets, HV Capital stands as a pillar of early-stage investment in Europe.

Who can invest?

mTBILL is meticulously designed for a global audience, adhering to German regulatory standards to ensure wide accessibility while prioritizing security and compliance. This approach opens opportunities for investors outside the U.S. to engage with a stable, yield-generating digital asset, underpinned by one of the most secure financial instruments available.

Interested in Investing or Learning More?

We invite you to explore the potential of mTBILL and discover how Midas is paving the way for a new era of financial innovation. Whether you're an investor seeking enhanced yield or a blockchain enthusiast interested in the future of DeFi, Midas offers a gateway to the next frontier in stable capital.

For more information on Midas and the mTBILL token, navigate to https://midas.app/, or contact us via team@midas.app.

For a technical deep dive, visit our documentation at https://midas-docs.gitbook.io/midas-docs.