Midas is thrilled to announce the launch of mBASIS, a tokenized delta neutral basis trading strategy

Midas’s mBASIS gives token-holders exposure to an institutional-grade basis trading strategy.

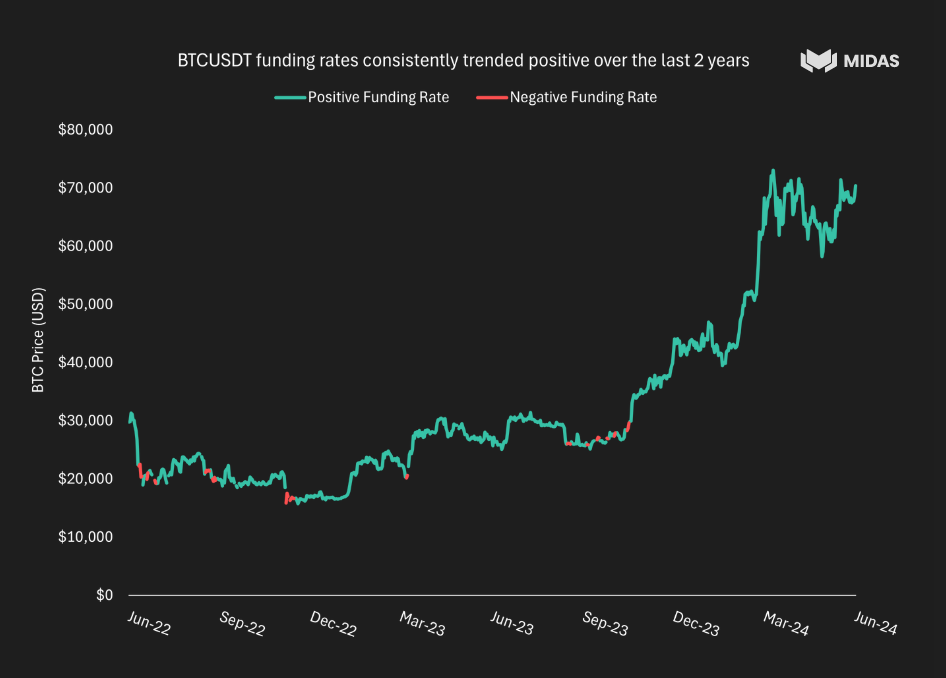

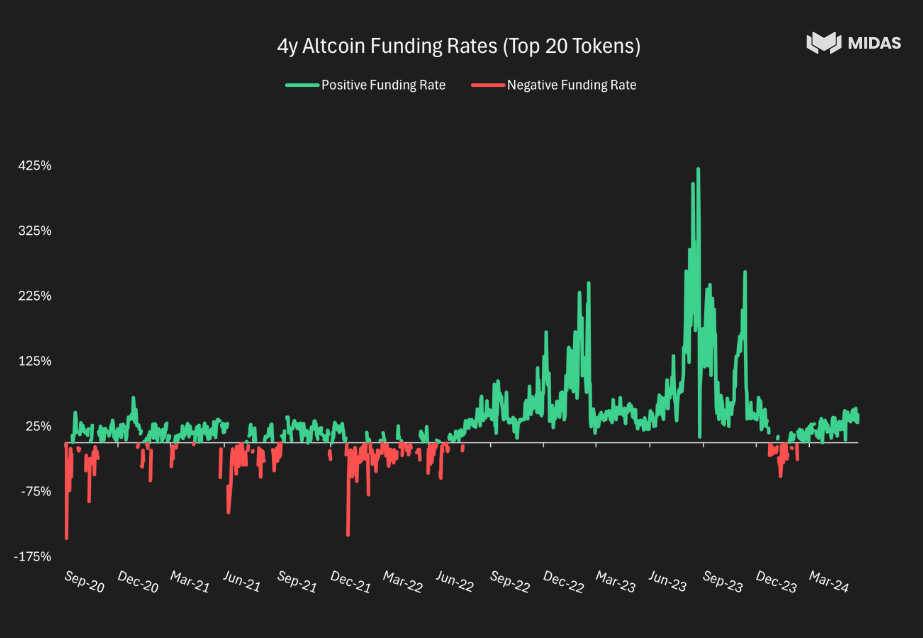

This strategy takes advantage of profitable crypto-basis positions during bull cycles when markets are in contango. The mBASIS token differentiates itself through its actively managed approach that dynamically allocates basis positions in the major large-caps (BTC & ETH) while incorporating yield from the top 20 altcoins. This meaningfully enhances the return profile, with market-neutral returns between 20% and 40% observed in past bull cycles.

During declining markets, the strategy adjusts to reverse basis trading, taking advantage of backwardation of the yield curve, or allocates into US T-Bills via Midas’s core product, mTBILL.

Midas partnered with a high-quality asset manager while providing a best-in-class tokenization infrastructure. As with all of Midas' products, this allows users to manage their assets onchain effectively, harnessing the flexibility of a permissionless ERC-20 token.

Institutional-Grade All-weather Strategy

The structure of the mBASIS token enables the allocation of funds into top 20 altcoins and US Treasuries further increasing potential yield and highlighting the strategy’s adaptability under all market conditions.

Midas’s institutional-grade tokenization offering

- Professional Asset Management: Assets invested in mBASIS are managed by a licensed asset manager with client fiduciary duties, exceeding current industry practices.

- Active Management: The strategy dynamically adjusts between the most attractive basis positions and US T-Bills across market cycles

- Transparent and Verified Reporting: The investment portfolio and its performance are prepared by an independent regulated fund administrator

- Bankruptcy Protection: Client assets are held in a bankruptcy protected SPV. In the unlikely event of a default, a security agent distributes assets to creditors.

Use cases

- Treasury management: Invest assets in mBASIS as a treasury management solution and accumulate capital.

- Borrow/lend: mBASIS can be used as yielding collateral in DeFi money markets to further enhance returns across the strategy.

- Transact: As a permissionless ERC-20 token, users are free to engage in a wide range of onchain use cases and can transact peer-to-peer.

Background

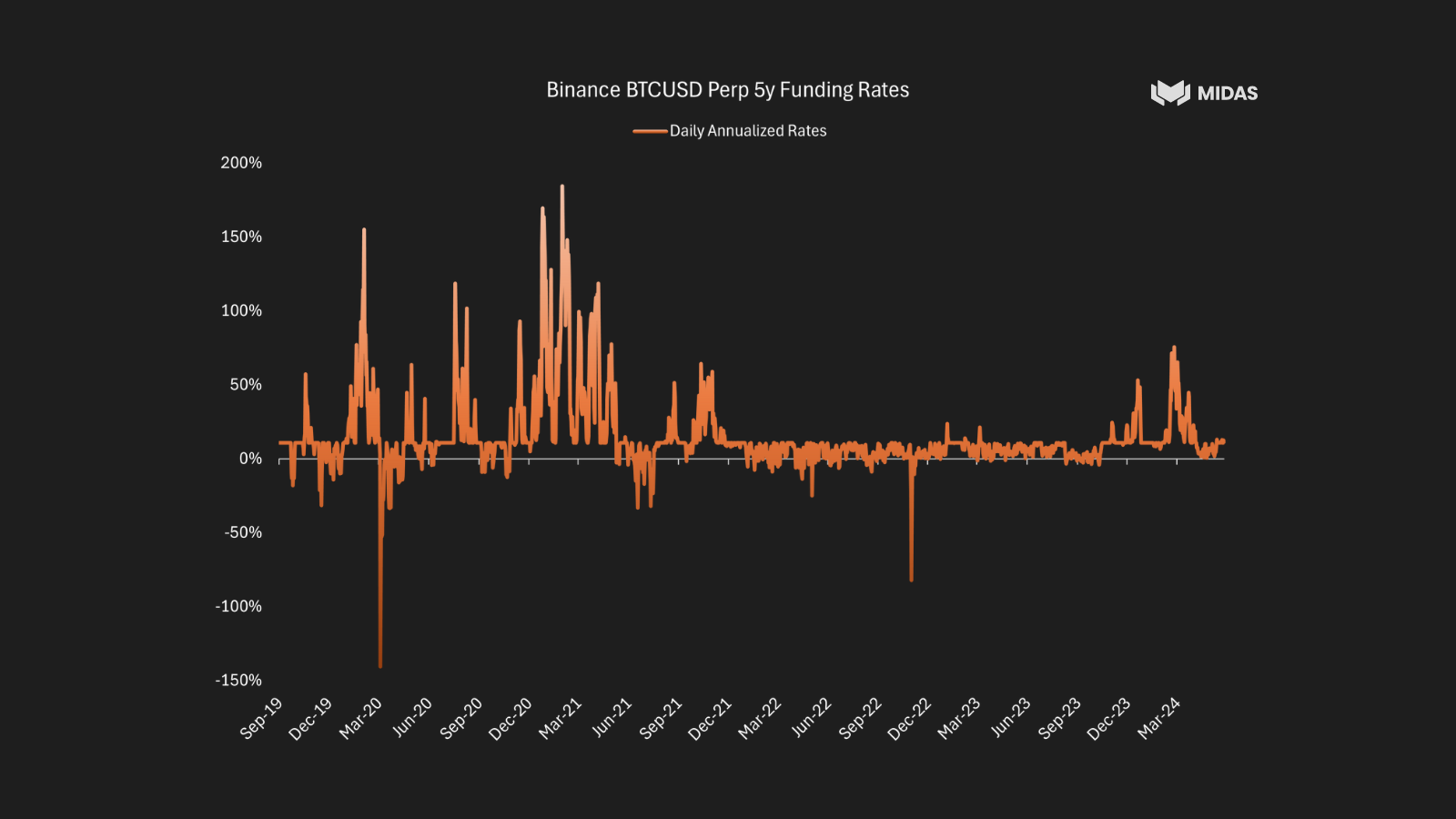

The basis trade

The basis trade involves the arbitrage of the price difference between the spot and perpetual futures markets. The strategy is composed of a spot-long position (e.g., BTC) and the sale of an equivalent amount into the perpetual futures market (short position). This locks the difference between the spot and futures prices, or the basis, as profit.

This approach ensures regular earnings from positive funding rates paid by long traders and shields the principal from market price fluctuations by balancing long and short positions.

Crypto market cycles

Crypto markets are cyclical, often influenced by significant events like a Bitcoin halving. These halving events contract the supply, leading to sharp price increases. Significant retail participation further drives up prices, reinforcing this trend.

The periods following Bitcoin halving events are historically associated with significant positive price action, which presents an opportunity for basis trades to harvest funding rates.

| Market Cycle | Start Price | End Price | Implied Price Appreciation | Time Period |

|---|---|---|---|---|

| 2012-2013 | ~$2.00 | ~$13.00 | ~550% | Late 2011 to early 2013 |

| 2013-2014 | $135.30 | $350.93 | 159% | Early 2014 to early 2015 |

| 2016-2017 | $350.51 | $650.96 | 86% | Late 2014 to mid-2016 |

| 2018-2020 | $6,955.27 | $29,001.72 | 317% | Early 2018 to mid-2020 |

About Midas

Midas is an asset tokenization protocol bringing regulatory-compliant exposure to institutional-grade assets onchain, unlocking DeFi composability for real-world assets (RWA).

Tokenizing securities in a compliant manner is complex, requiring deep legal expertise and iterative development. Each Midas-issued token represents a bold step forward, merging the reliability of traditional financial instruments with the efficiency and accessibility of DeFi.

For additional details on the mBASIS token or to explore investment possibilities with Midas, please visit https://midas.app/.

Funding Round

Midas is backed by the leading investors in the RWA space as BlockTower, alongside Framework Ventures and HV Capital co-lead its recent $8.75 funding round.

The round also saw participation from Cathay Ledger, 6th Man Ventures, Coinbase Ventures, Hack VC, GSR, Lattice Capital, Phaedrus, Theia Blockchain, Pareto, Axelar Foundation, Peer VC and FJ Labs.

Disclosure

The mBASIS token is not available to US persons and entities, or those from sanctioned jurisdictions. The minimum investment amount is EUR 100,000. Certain investors, such as Qualified Investors, may be able to invest at lower minimum amounts.

For more information on Midas and the mBASIS token, navigate to https://midas.app, or contact us via team@midas.app.

For a technical deep dive, visit our documentation at https://docs.midas.app.