Liquid Yield Tokens (LYT): Redefining On-Chain Yield Strategies

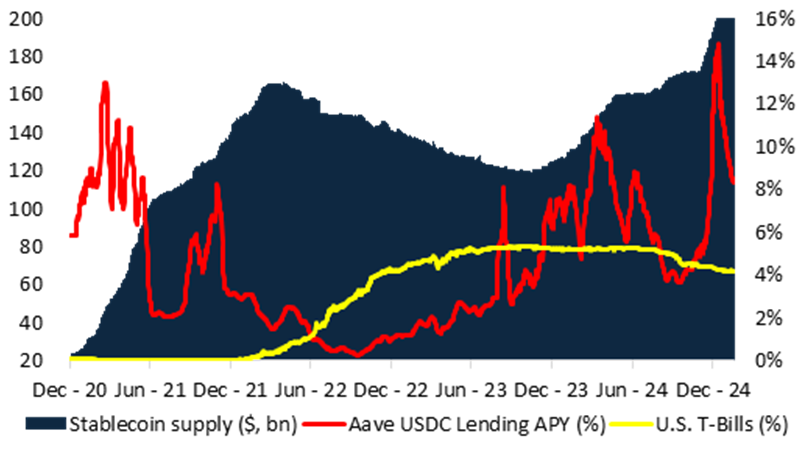

Stablecoins are hailed as the cornerstone of the crypto ecosystem, offering stability in volatile markets and promising to overhaul financial rails. Underneath the surface, however, stablecoin supply is fundamentally tied to on-chain yield, as shown by the past two cycles.

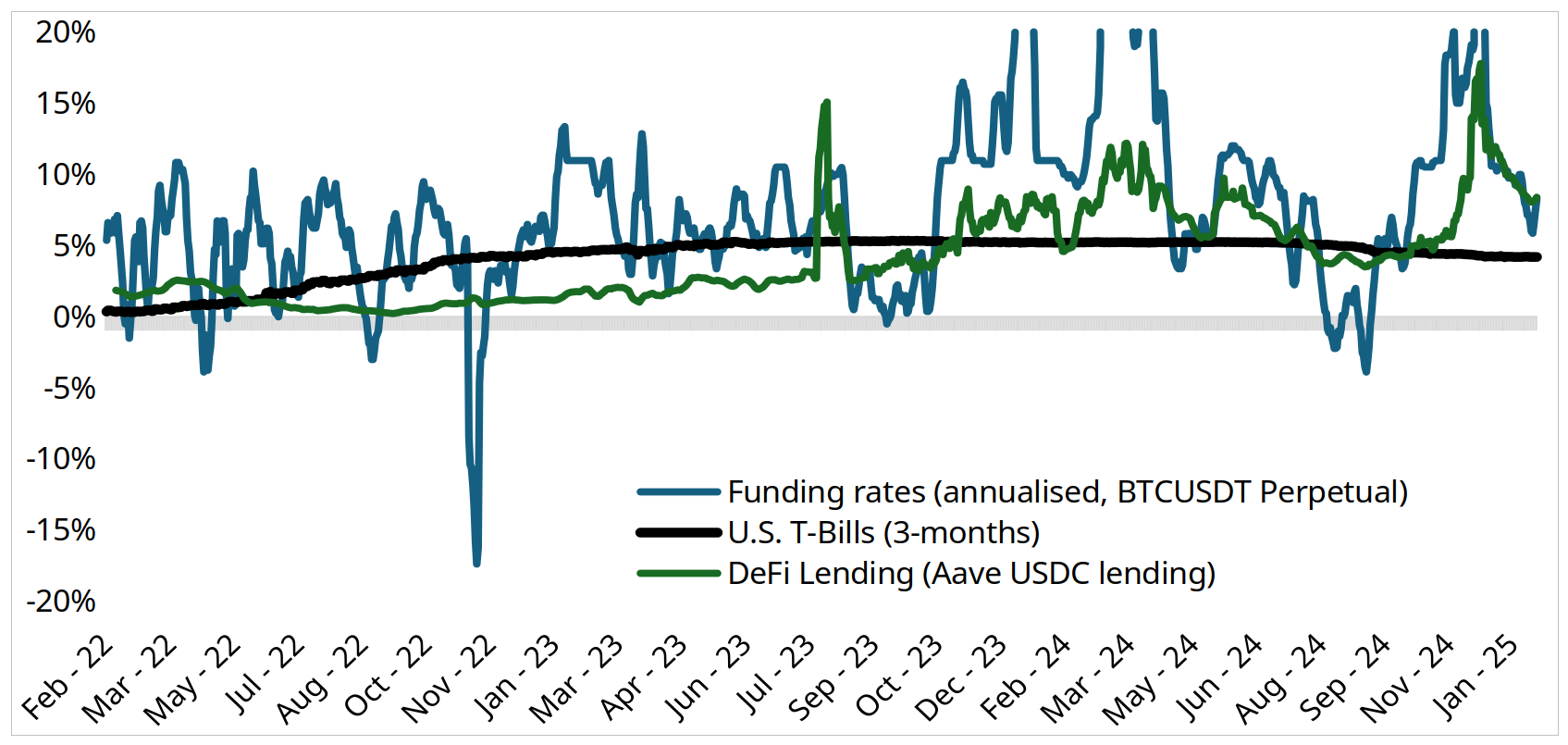

DeFi summer (2022) introduced yield on stablecoins via over-collateralised lending, resulting in a surge of stablecoin supply from <$10 billion to over $150 billion in just two years. By contrast, as yields fell, supply contracted just as quickly between 1Q22 to 3Q23. Recent growth is explained by tokenised cash-and-carry trades with associated high on-chain yield - but the trend is reversing.

The Problem: Stablecoins Aren’t Stable

In the search for yield, stablecoins have evolved into on-chain hedge funds ("yield-bearing stablecoins"), as shown by the growth of Ethena and others. In this structure, the yield is distributed via two tokens – a conventional $1 pegged stablecoin, which can be staked into a second token to earn the revenue of the underlying collateral. This structure has emerged because issuing a “stable”- coin avoids classification as a security or a collective investment scheme (i.e. ‘fund’), which would require regulatory approval.

By framing these products as “quasi stablecoins”, issuers navigate regulatory grey area – however, this comes at the cost of introducing notable risks, including:

- De-Peg Events: If the portfolio underperforms, a run-on-the-bank scenario salvages residual value for all token holders, destabilizing the ecosystem.

- Misaligned Incentives: Issuers compete for higher yields, pushing portfolios further up the risk curve to attract Total Value Locked (TVL), increasing systemic risk.

- Regulatory Grey Areas: Wrapping hedge fund strategies into “quasi-stablecoins” skirts securities regulations but might introduces regulatory risks. Investors don’t have a legally defined claim on the underlying collateral.

As Steakhouse Financial notes in their Stablecoin Manual: “Stablecoins are subject to liquidity and solvency constraints. To function, a stablecoin must meet both of these hard constraints”. The very structure of yield-bearing stablecoins pushes these constraints to their limits. Issuers compete on yield to attract TVL, which leads to two systemic consequences: first, crowding of trades within identical zero-duration yield assets, and second, an increasing fragility that heightens the risk of large-scale de-pegs.

The Consequences: Lower Returns & Increased Systemic Risk

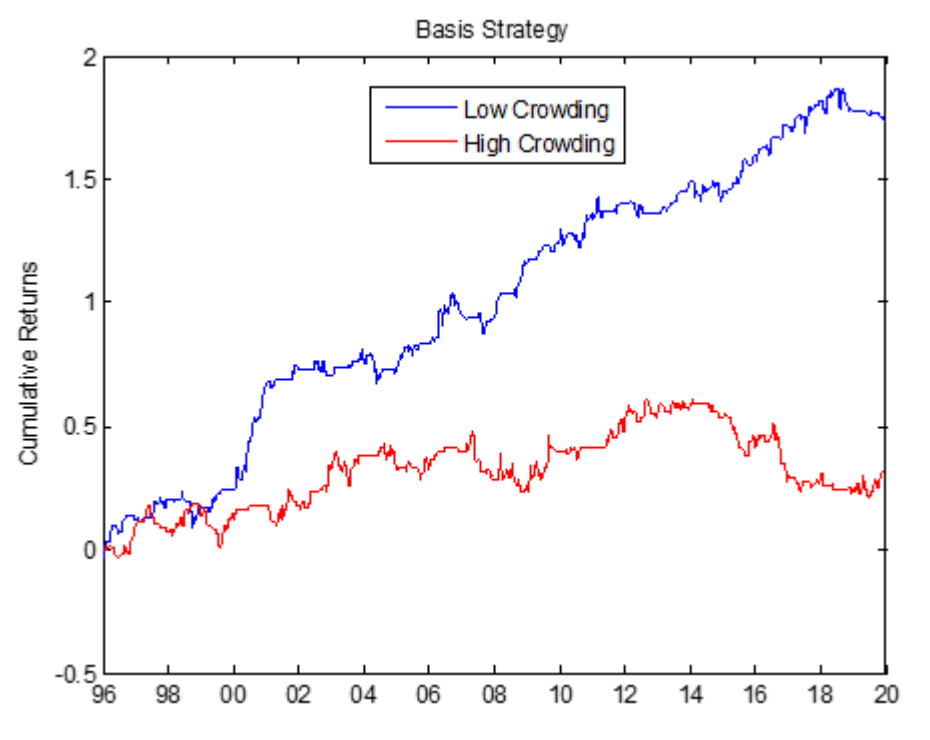

By setting a $1 liability, the investable universe for the collateral of yield-bearing ‘stablecoins’ are technically restricted to zero-duration collateral (with "zero-counterparty risk"). This funnels assets across all issuers into the same trades, leading to diminishing returns and increased risks. The effects of market crowding have extensively been studied in academia¹²³⁴ to result in lower returns at higher risk. For instance, the basis-trade⁵ in commodities market has resulted in consistently in lower returns over a 24-year period.

Beyond crowding, the relentless pursuit of yield pushes issuers further up the risk curve. In doing so, they introduce systemic fragility, where a single weak link in the collateral pool can cause a cascading failure. As DeFi users enjoy leverage and rehypothecation to increase adoption while farming rewards, stress in one segment of the collateral structure can have an outsized impact. When an underlying yield strategy underperforms or unwinds, the stablecoin can no longer meet redemptions at par value - leading to a de-pegging event. This effect was evident in the 2022 stETH discount, the collapse of UST, or more recently shown by the de-peg of USD0++ and USDz.

Introducing on-chain native yield: Liquid Yield Tokens (LYT)

At Midas, we address these shortcomings through a combination of technical and regulatory infrastructure. Instead of wrapping yield-products into "quasi stablecoins", Midas has a regulatory authorisation to issue native on-chain yield instruments. Liquid Yield Tokens (LYT) represent a new class of on-chain assets:

- Higher risk-adjusted Returns from Expanded Investable Universe: By removing the $1 liability constraint, the collateral can include assets beyond zero-duration collateral, unlocking better risk-adjusted returns limited from crowding and market conditions.

- Floating Reference Value: Unlike traditional stablecoins, LYT’s value is not pegged to $1. Instead, it fluctuates based on the performance of the underlying, eliminating the risk of de-pegging. Midas’s approved prospectus allows it to issue regulatory compliant stablecoin yield strategies without a “quasi-stablecoin” wrappers.

- Shared liquidity to support DeFi Integrations: All Liquid Yield Tokens issued by Midas share a common liquidity pool that allow atomic redemption at par value. Instead of incentivised new liquidity pools for each token, this structure allows for capital efficient scaling and integration of LYTs into DeFi protocols. Morpho, Euler, Ajna and others already support existing LYTs such as mTBILL and mBasis.

- Reward Farming at Scale: Users get exposure to additional rewards captured by risk-managers. Midas has partners with the largest funds in DeFi with track-record to obtain access to early-stage liquidity provisioning deals. Additionally, LYTs will be minted in ecosystems that support additional rewards such as TAC, Oasis, Plume, Etherlink and more.

- Professional Risk Management: Dedicated risk managers dynamically allocate collateral to balance risk-reward analysis within their investment mandate. This design is intended to capture alpha across changing market conditions in DeFi and Traditional Money Markets.

How Liquid Yield Tokens (LYT) Work

Liquid Yield Tokens (LYT) are issued through Midas’ composable infrastructure. This approach separates the roles of issuer and risk manager, allowing users to benefit from customised risk curation.

The collateral of each token is managed by dedicated risk managers who operate under specific mandates and reported transparently on-chain. The risk manager dynamically allocates collateral to the most effective opportunities, adapting to changing market conditions to capture alpha while managing risks.

Yield delivered by top-tier Asset Managers

Midas has partnered with the best asset managers in the industry to deliver top-tier yield products across a spectrum of strategies and risk-profiles.

- RE7 Capital is an award-winning research-driven digital asset investment firm specialising in DeFi, alpha generation and risk management. Re7 Capital’s approach spans a diverse range of solutions that cater to crypto-native institutional and professional participants and foundations.

- MEV Capital is an Investment & risk management firm focused on open-ended strategies across Decentralized Finance on EVM chains since 2020.

- Edge Capital is a leading market-neutral hedge fund that manages capital for largest fund of funds, institutional investors and leading crypto foundations and treasuries since 2020.

- BlackRock is one of the world's preeminent asset management firms and a premier provider of investment management.

These risk managers generate yield through a range of strategies that users get exposure to. These include:

- Liquidity provision, where capital is deployed into deep, institutional-grade trading venues to capture transaction fees while remaining market-neutral.

- Carry trades optimize funding differentials by borrowing at low rates and lending at higher rates, often through structured tokenized instruments.

- Liquidation arbitrage captures opportunities in DeFi by participating in undercollateralized loan liquidations, benefiting from discounted asset acquisitions.

- Reward farming provides exposure to early stage token-allocation with additional rewards for liquidity provisioning.

Built for DeFi

Each Liquid Yield Tokens (LYT) is issued as a permissionless ERC-20 token, allowing composability with the broader DeFi ecosystem. Across all tokens, Midas has implemented shared liquidity for instant-redemptions. This novel approach allows for capital efficient redemption across all Liquid Yield Tokens (LYT), which unlocks DeFi use-cases that otherwise would require expensive subsidies to achieve liquidity pool in DEXes.

Invest Now mRe7YIELD | mEDGE | mMEV

Disclaimer: This announcement does not constitute an offer to sell or the solicitation of an offer to buy any securities. The offering is made exclusively on the basis of the information contained in the formal prospectus issued in connection with the offering. The prospectus is available at https://docs.midas.app/resources/legal-documents/prospectus-documents. Any decision to invest in the securities should be based on a consideration of the prospectus as a whole by the investor. The approval of the prospectus by the FMA should not be understood as an endorsement of the quality of the offering. Past performance is not indicative of, and does not guarantee future results. Investing in digital assets including crypto assets is not suitable for every investor as there is a substantial risk of loss, and losses in excess of an initial investment may under certain circumstances occur.

¹ Brown, Gregory. and Howard, Philip and Lundblad, Christian (2019), "Crowded Trades and Tail Risk", June 2, 2019

² Chincarini, Ludwig, Lazo-Paz, Renato and Moneta, Fabio (2024), "Crowded Spaces and Anomalies". April 2014

³ Conlon, Thomas, Cotter, John, and Jain, Kushagra, (2004), "Crowding and Downside Risk: International Evidence", pre-print submitted to Elsevier, November 26, 2024

⁴ Stein, Jeremy (2009), "Sophisticated Investors and Market Efficiency", Journal of Finance

⁵ Wenjin Kang, K. Geert Rouwenhorst and Ke Tang Crowding and Factor Returns 2021